Next Working Day Delivery

Orders received by 3pm Monday-Thursday and 1pm Friday will be despatched same day.

How Hague is helping accountancy practices and payroll administrators

February 17th 2021

With the payroll and accounting year-end edging ever closer, businesses need to be well informed when it comes to potential changes that may affect them. This is especially the case in the light of Brexit and the various changes to circumstances we’ve all encountered over the previous year.

Here at Hague Direct, we want you to be prepared for every eventuality and to help you maintain high levels of productivity and accuracy in your payroll and accounting departments. For this reason, we’ve created a quick rundown of the key changes you’re likely to see (or have already seen take effect) over the coming twelve months in the UK.

Four key accounting and payroll changes in 2021 to be aware of

- Sage Accounting goes digital

UK Accountancy software giants, Sage launched a new cloud-based accounting solution at the start of 2021. It allows you to complete financial reports, create invoices, process payments, manage VAT and file taxes. However, many businesses use printed forms and you still have the option to do so. We have a wide range of Sage compatible forms available.

- The furlough scheme will end

The Coronavirus Job Retention Scheme is set to end on 30th April 2021. This furlough scheme has protected an estimated 9 million jobs through the challenge of the last year and has given employees 80% of their pay up to a total of £2,500 to help safeguard them from financial hardship. Having said that, it could be extended once again, continuing to affect payroll throughout 2021.

UPDATE 3rd March 2021: Rishi Sunak has confirmed in his Budget the furlough scheme will be extended until the end of September.

- Taxes may increase

Back in 2020, the government warned that it would have to increase taxes in order to make up for the shortfall caused by the furlough scheme. We will find out whether this is the case on the 3rd March 2021 when the chancellor, Rishi Sunak announces the budget.

Potential changes could include an increase in Class 4 National Insurance, a decrease in pension tax relief, and an increase in Capital Gains Tax, but nothing has been confirmed at this stage.

- New IR35 will come into effect in 2021

Although the new IR35 rules were delayed in 2020, they will finally come into effect on 6th April 2021. This will shift the responsibility for determining the tax status of a contractor from the worker to the organisation.

How can the team at Hague Direct support you with some of these changes?

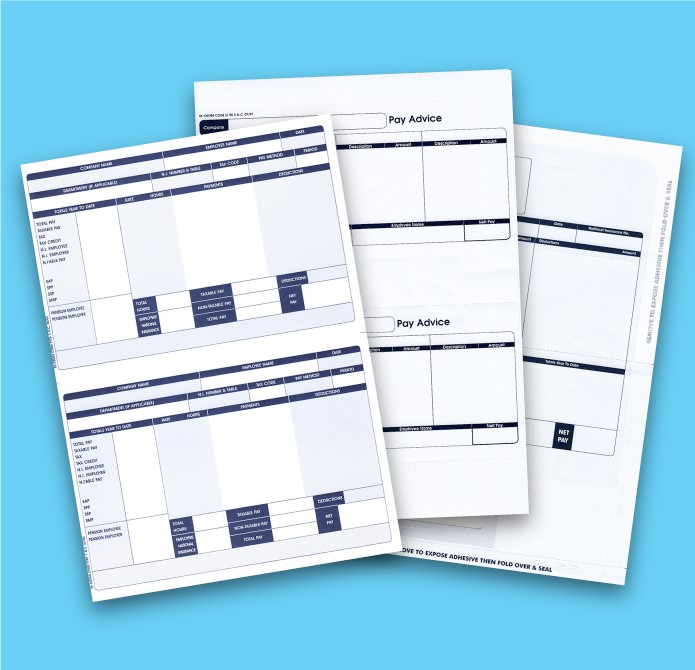

Accountancy practices and payroll departments are already seeing several of these changes starting to be ushered in. For example, Sage, as we mentioned earlier, withdrew certain stationery products from sale at the end of last year. Thankfully, if your organisation relies on Sage software for accounting, finances, payroll, or HR, you are still able to use compatible forms from other suppliers. And who better to help than Hague Direct? We’re proud to be one of the UK’s leading stockists of Sage-compatible accounting forms, including payslips, P60s and we also supply many Iris and Pegasus-compatible products too.

Whatever lies ahead, we’re here to provide exceptional custom printing solutions for payroll and accounting. Because despite the many changes on the horizon, there’s one thing that will never change – the quality of service we provide.

Contact us today for help.