Next Working Day Delivery

Orders received by 3pm Monday-Thursday and 1pm Friday will be despatched same day.

A quick guide to P60’s

January 20th 2020

Employers legal requirements for issuing P60’s

Acquiring or growing a business is an exciting time, but being an employer comes with many legal obligations. One of these being managing your payroll. In this article, we cover what your legal obligations are in relation to issuing employees with P60’s.

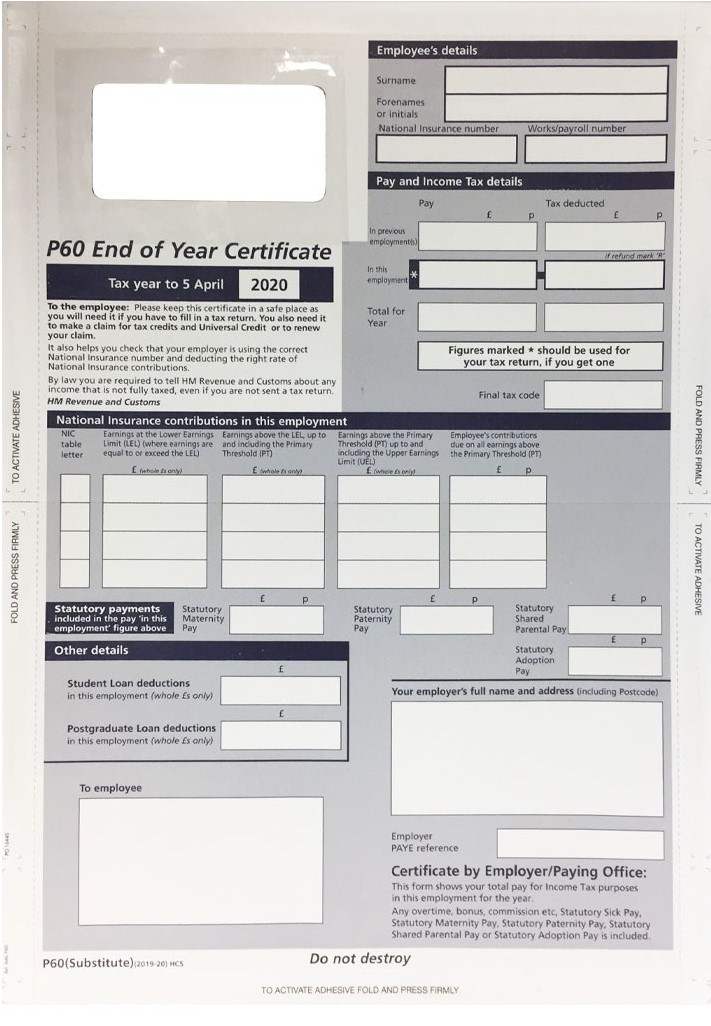

What is a P60?

You may hear a P60 being referred to as a Year End Certificate. A P60 is an annual statement that is given to people on your payroll, and it breaks down what they’ve earned during a tax year (6th April – 5th April) and what deductions, such as National Insurance Contributions and tax, have been made.

The majority of payroll software that is available today comes with the function to automatically produce P60’s. If you don’t use payroll software, or if the software you use doesn’t have this function, you can order copies of P60’s from HMRC.

When is a P60 given?

As an employer, it’s your responsibility to provide each person on your payroll, who was working for you on 5th April with a P60.

A P60 must be issued by 31st May after the end of the tax year. As an example, for the 2019/20 tax year (6th April 2019 to 5th April 2020), the P60 must be issued by 31st May 2020.

The only circumstance where you aren’t required to issue a P60 is when an employee left your employment during the tax year. All the information that would have been on their P60 would instead be included on their P45.

P60 – what it includes

A P60 contains various pieces of information, specifically relating to the employee and their earnings. On a P60 you’ll find spaces to detail the employee’s surname, forename or initials, National Insurance number and worker or payroll number.

There’s also a section for pay and tax deducted from previous employment, pay and tax deducted from this employment, total pay for the year, total tax deducted for the year and the employee’s final tax code.

P60’s are an important document and employees may need them if they’ve paid too much tax and they want to claim it back. Or, they may be asked to present their P60 when applying for tax credits or a mortgage.

We offer a range of P60 tax forms that are compatible with leading accounting software. Get in touch with us using our online contact form to find out more about our different forms.